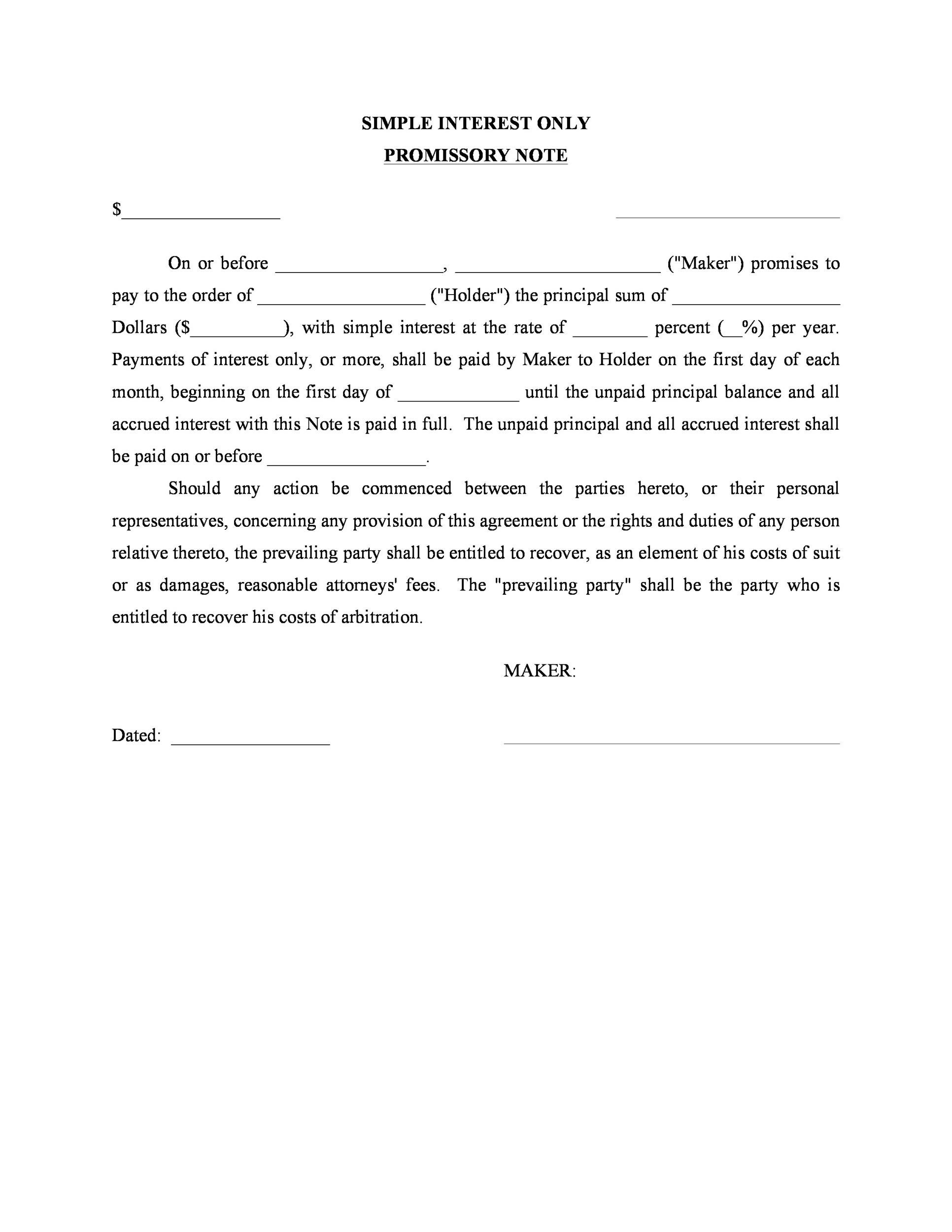

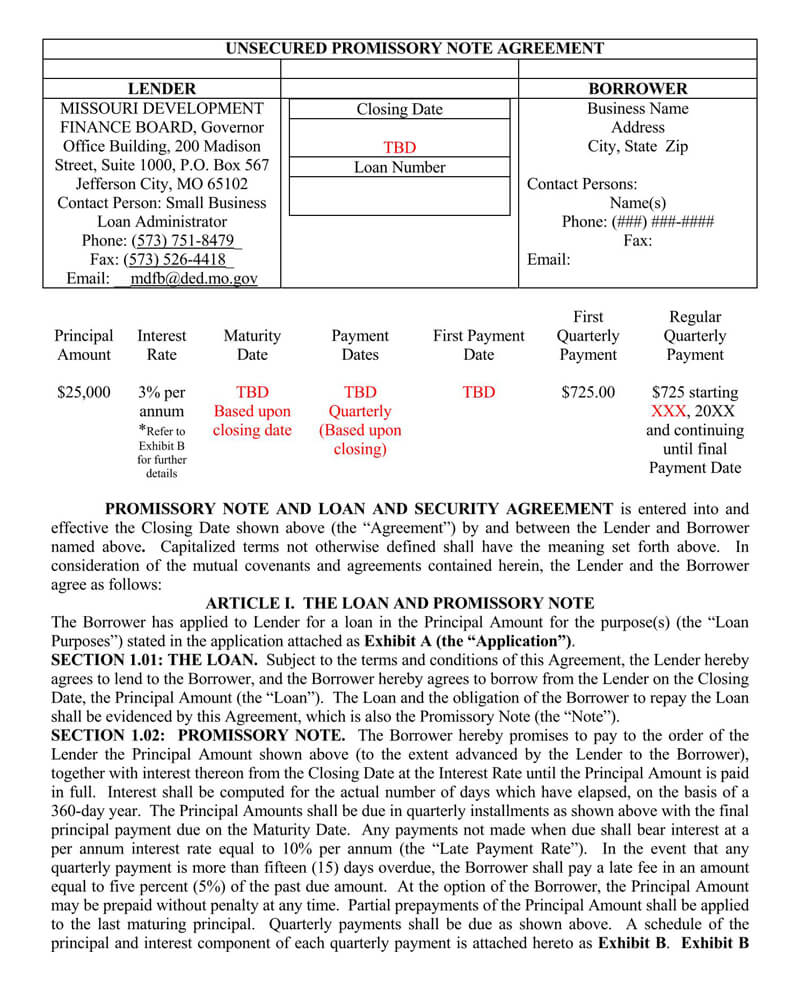

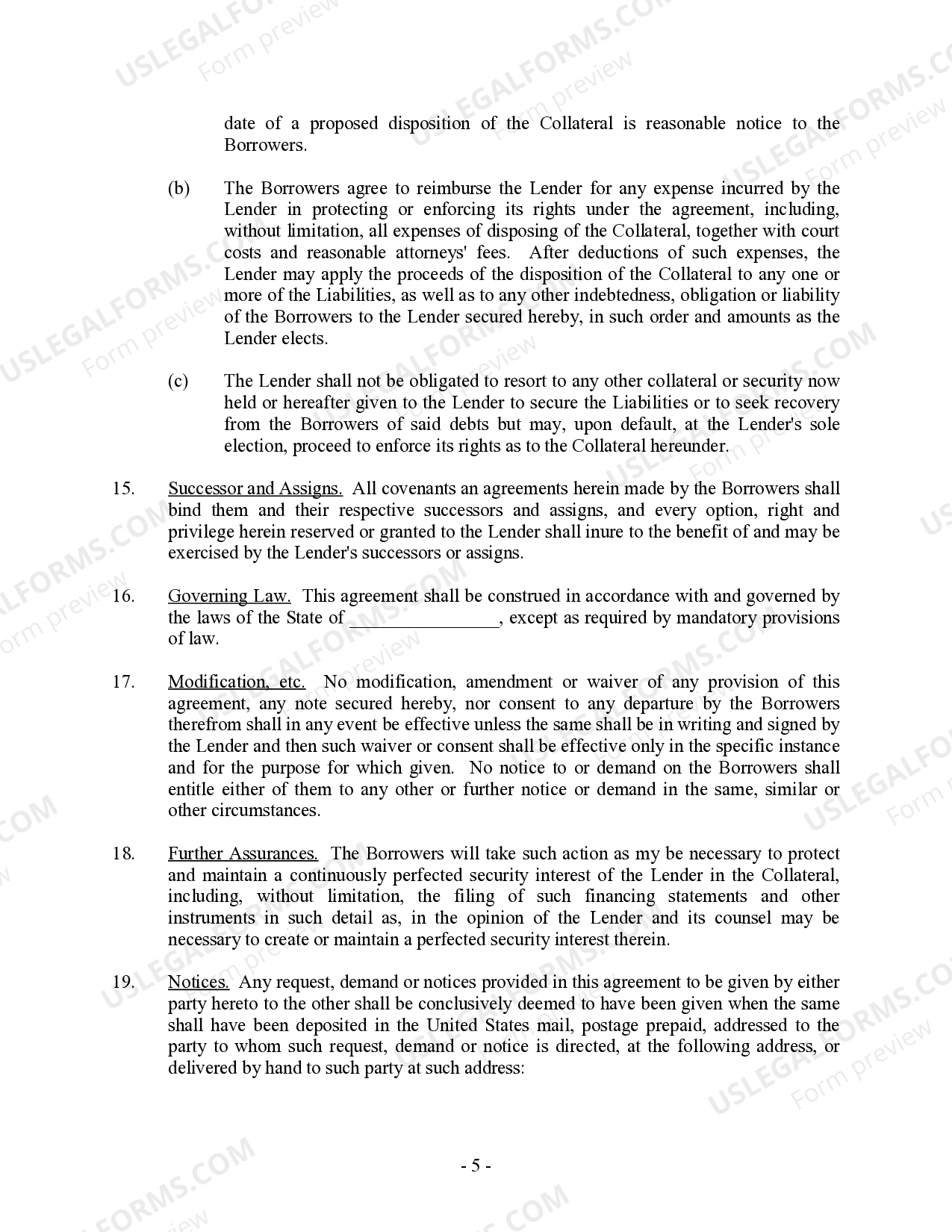

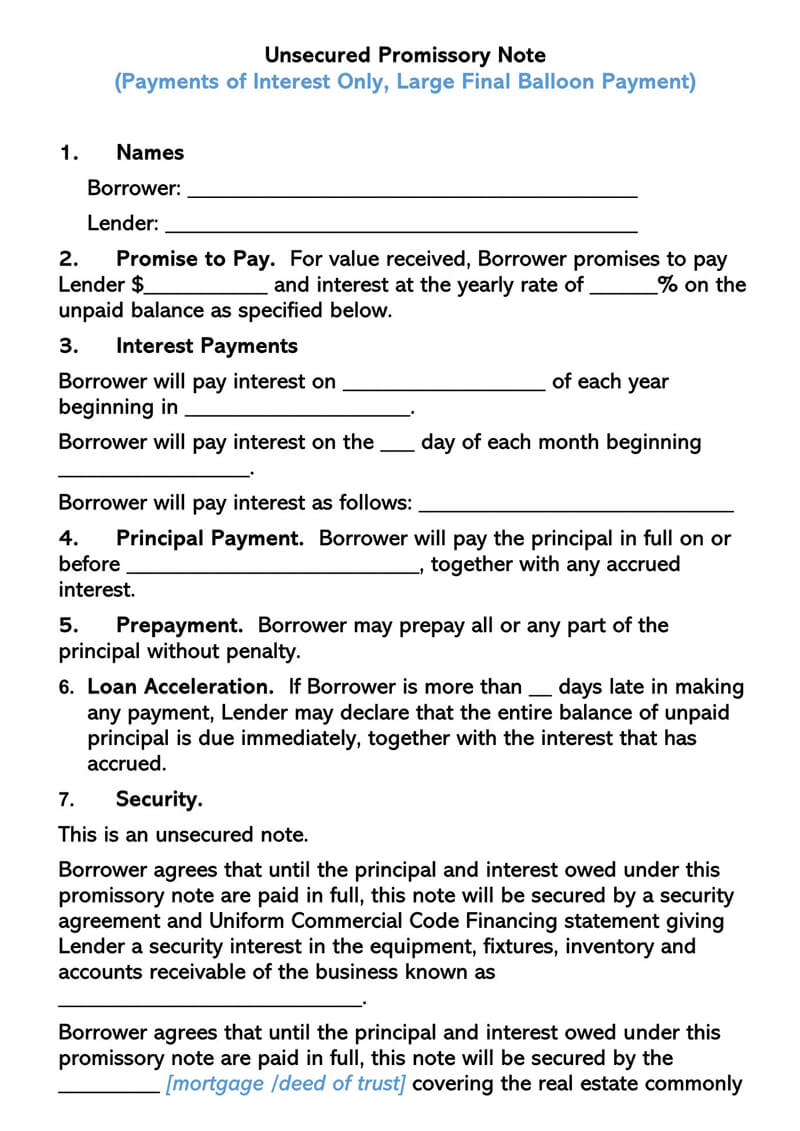

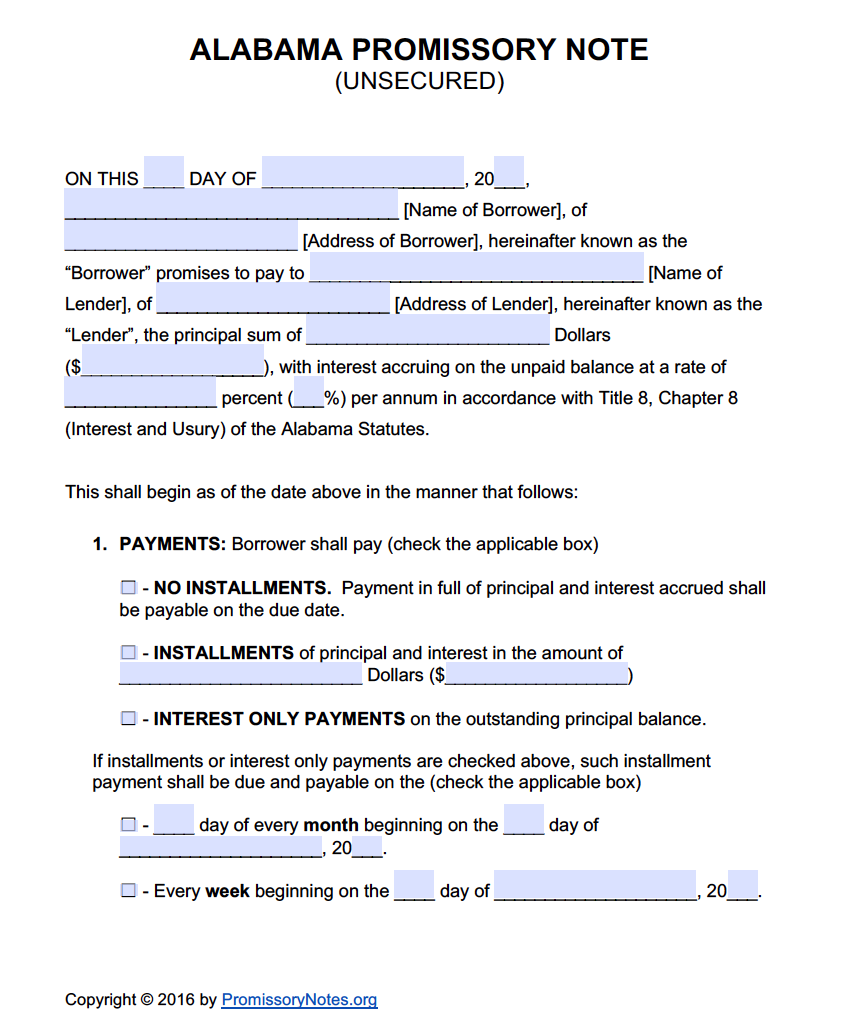

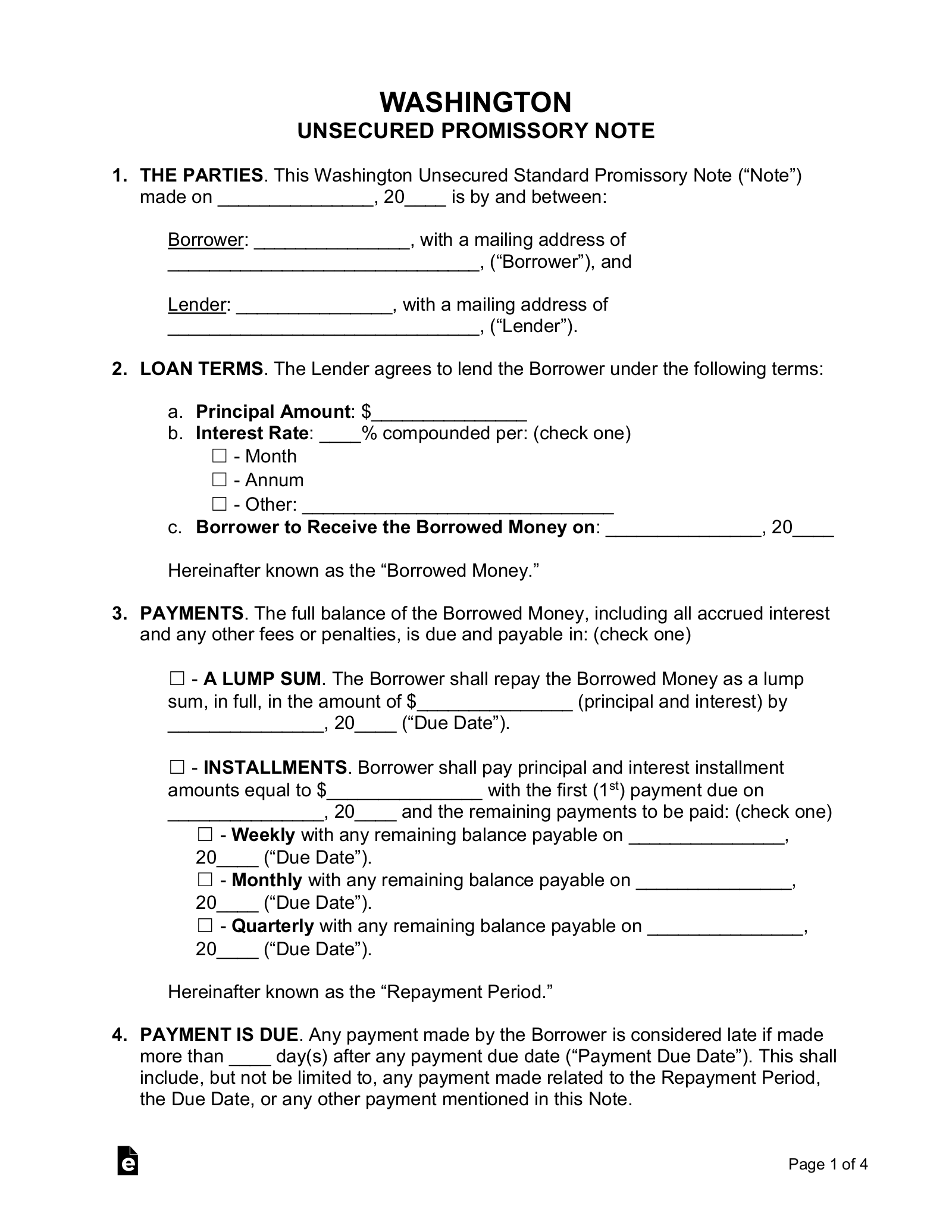

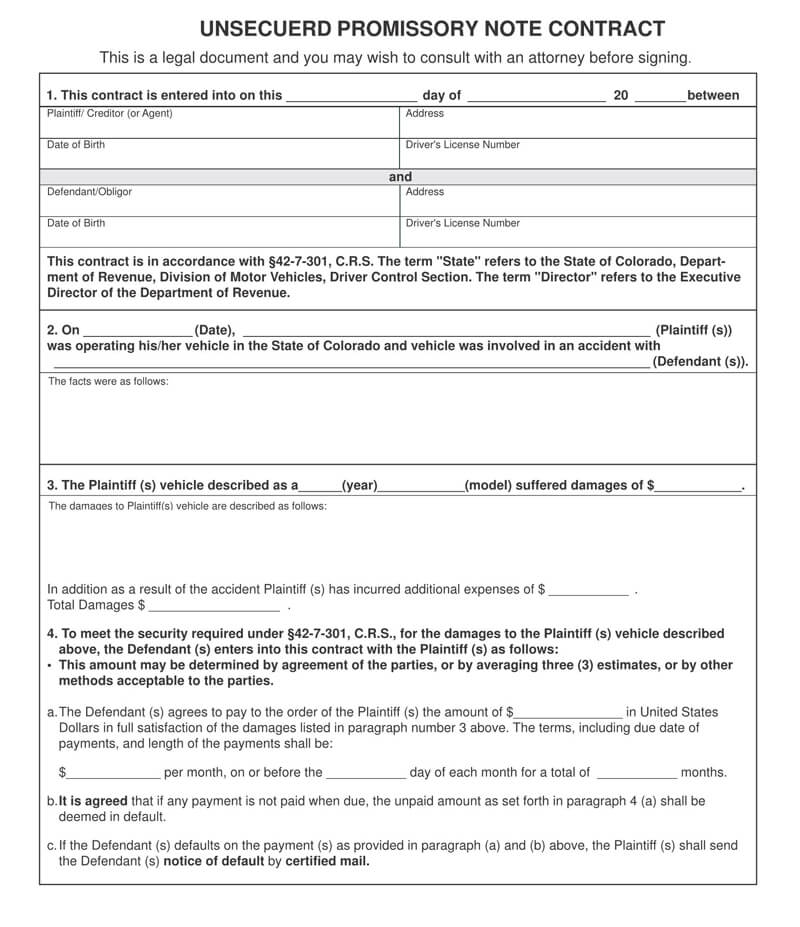

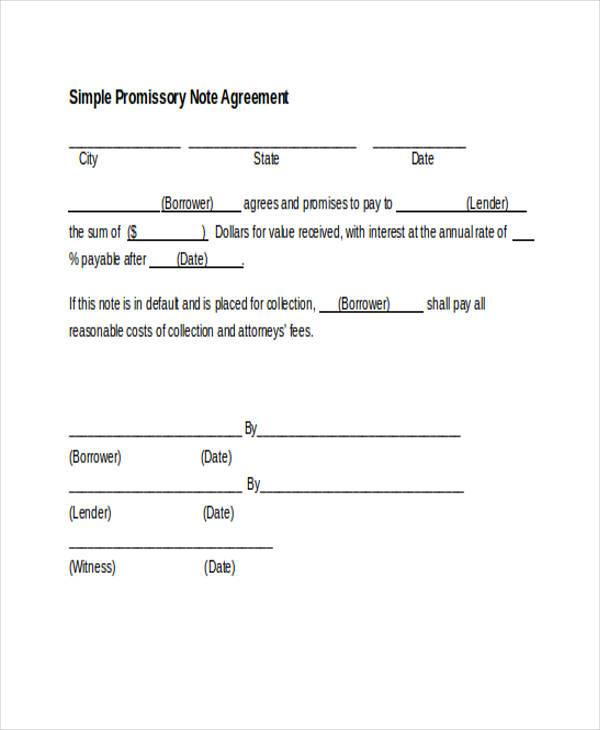

Unsecured Promissory Note Agreement. Nonetheless, the unsecured promissory note does help to ensure that the funds will be repaid because it demonstrates that the borrower knew what he or she was agreeing to in signing the loan. Sample promissory note forms with various repayment options, secured or unsecured loans and guidelines on how to compile your loan agreement - all free Our selection of free promissory notes and loan agreements can be downloaded instantly and used as templates or sample documents to.

Whether or not the loan will be secured or unsecured.

An unsecured promissory note is a legal document that is signed along with a loan.

A promissory note is a note that makes a declaration or a promise to pay and is used as a legal document to ensure that the buyer promises in writing to pay the amount being loaned. When a debt is unsecured, in the event that the borrower declares bankruptcy the debt secured by the note will only be repaid after all debts to secured creditors have been paid. It also often includes elements of security (eg. putting up a house as collateral) whereas a promissory is typically unsecured.