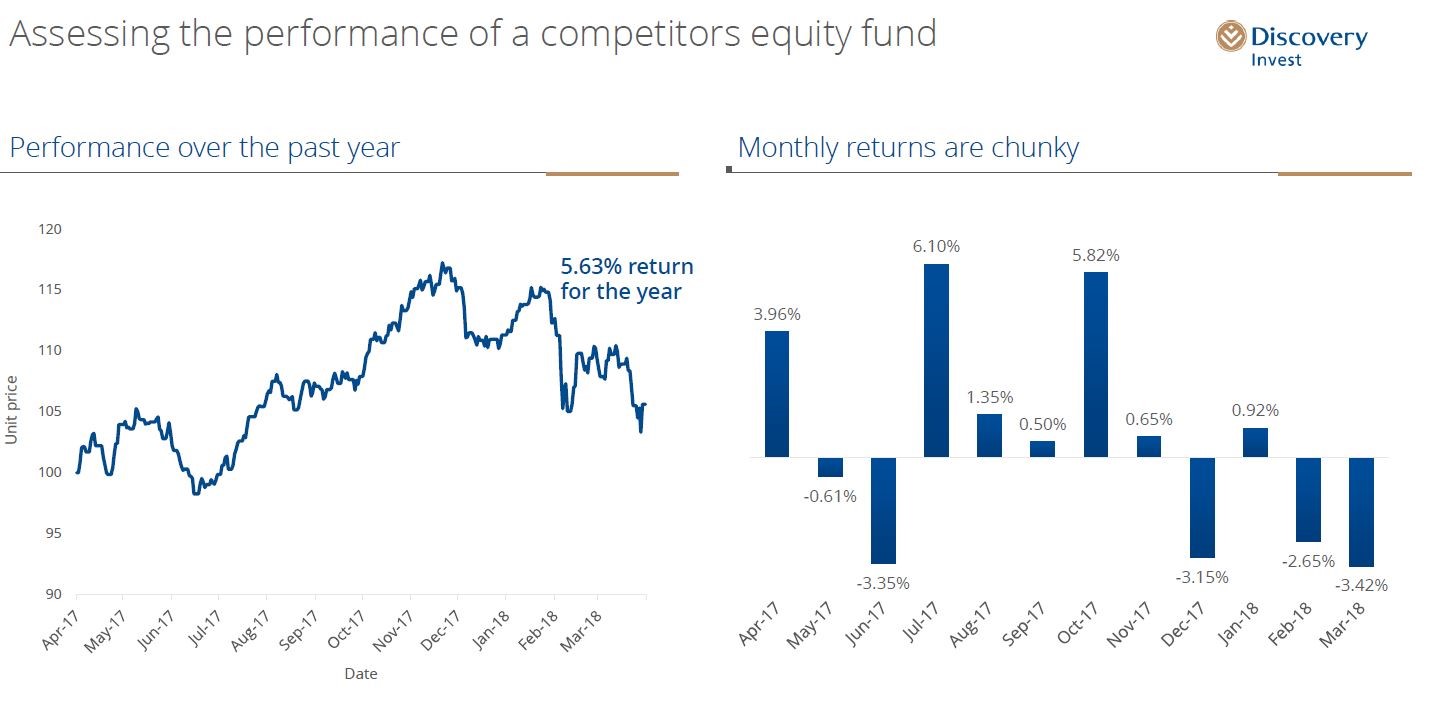

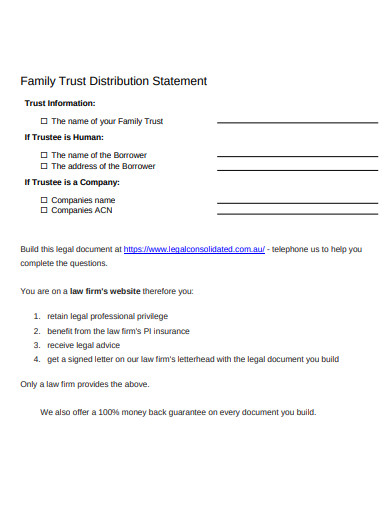

Unit Trust Distribution Statement Template. How unit trusts work describes unit trust dividends, investment unit trust, income unit trusts, what is unit trust, role of trustee, advantages and disadvantages of having a unit trust. Fund managers run the unit trust and trustees are often assigned to ensure that the fund is run according to its goals and objectives.

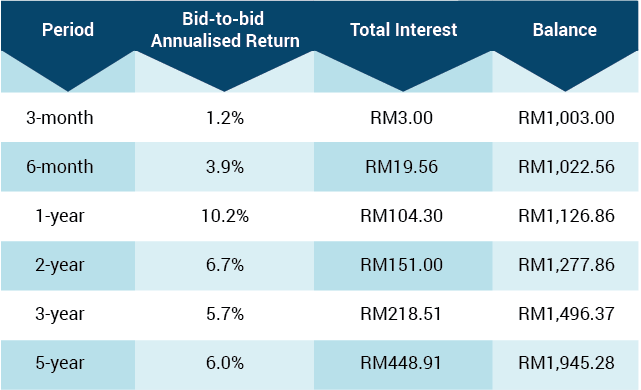

So unit trust is where small investors pool their money together, the money then kept by a trustee and managed/invested by UTMC (unit trust management This dividend can be reinvested, giving you more units.

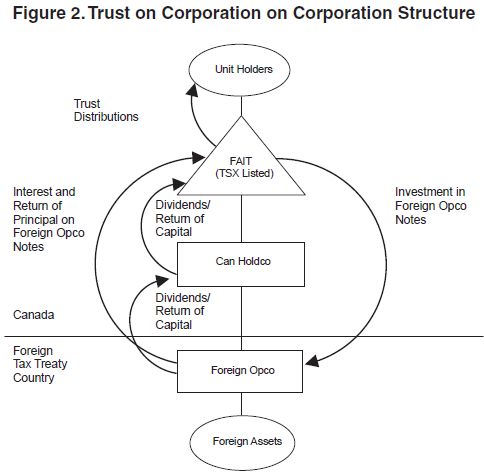

When completing the statement of distribution in their trust tax return, trustees of public unit trusts can aggregate reporting of income for which the trustee will not be assessed, provided they are also required to lodge an Annual Investment Income Report (AIIR) for that year of income.

Fund managers run the unit trust and trustees are often assigned to ensure that the fund is run according to its goals and objectives. Understand how unit trusts and funds work and things to look out for before you invest. An equal portion representing part ownership of a unit trust fund Any unclaimed net proceeds or other cash (including unclaimed distribution payments) held by the To view the Investment Adviser's Best Execution Policy - Client Disclosure Statement, please.