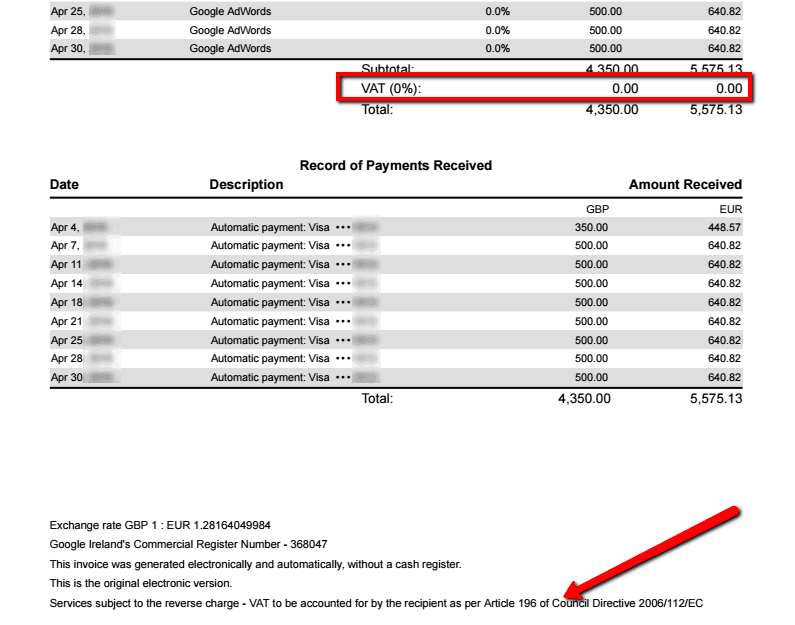

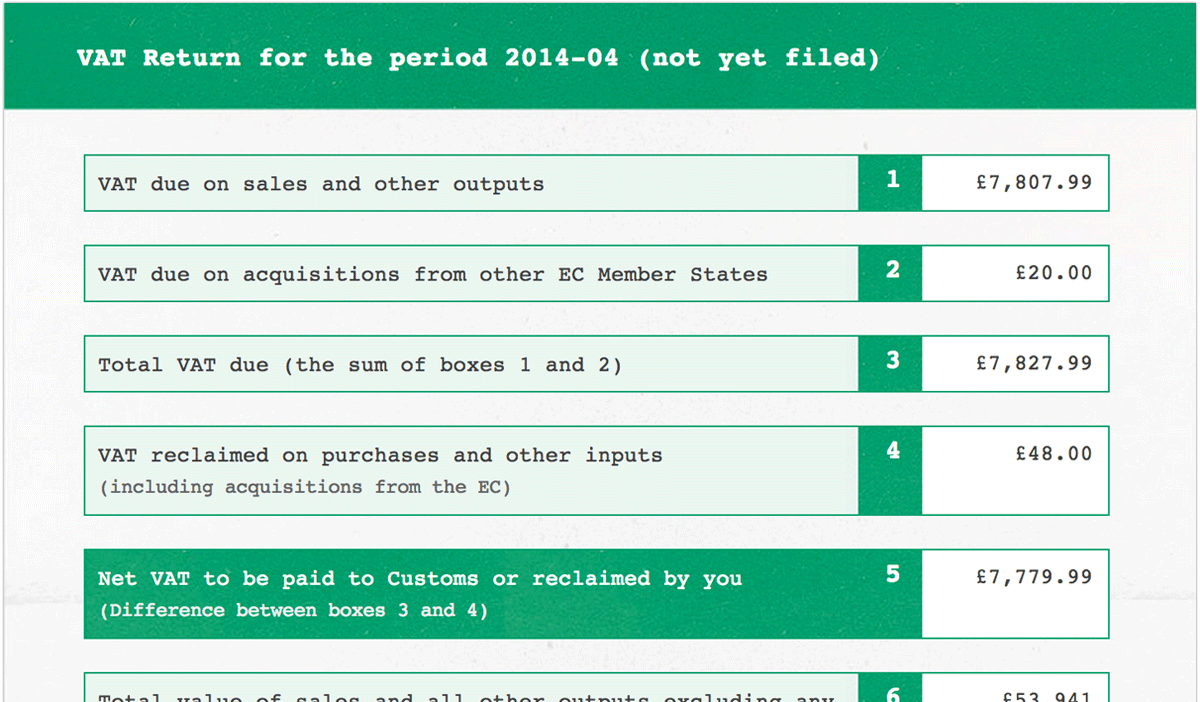

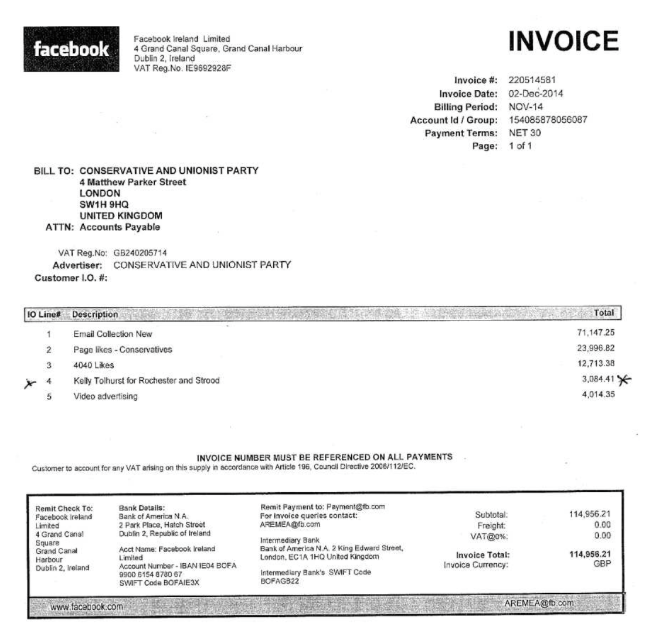

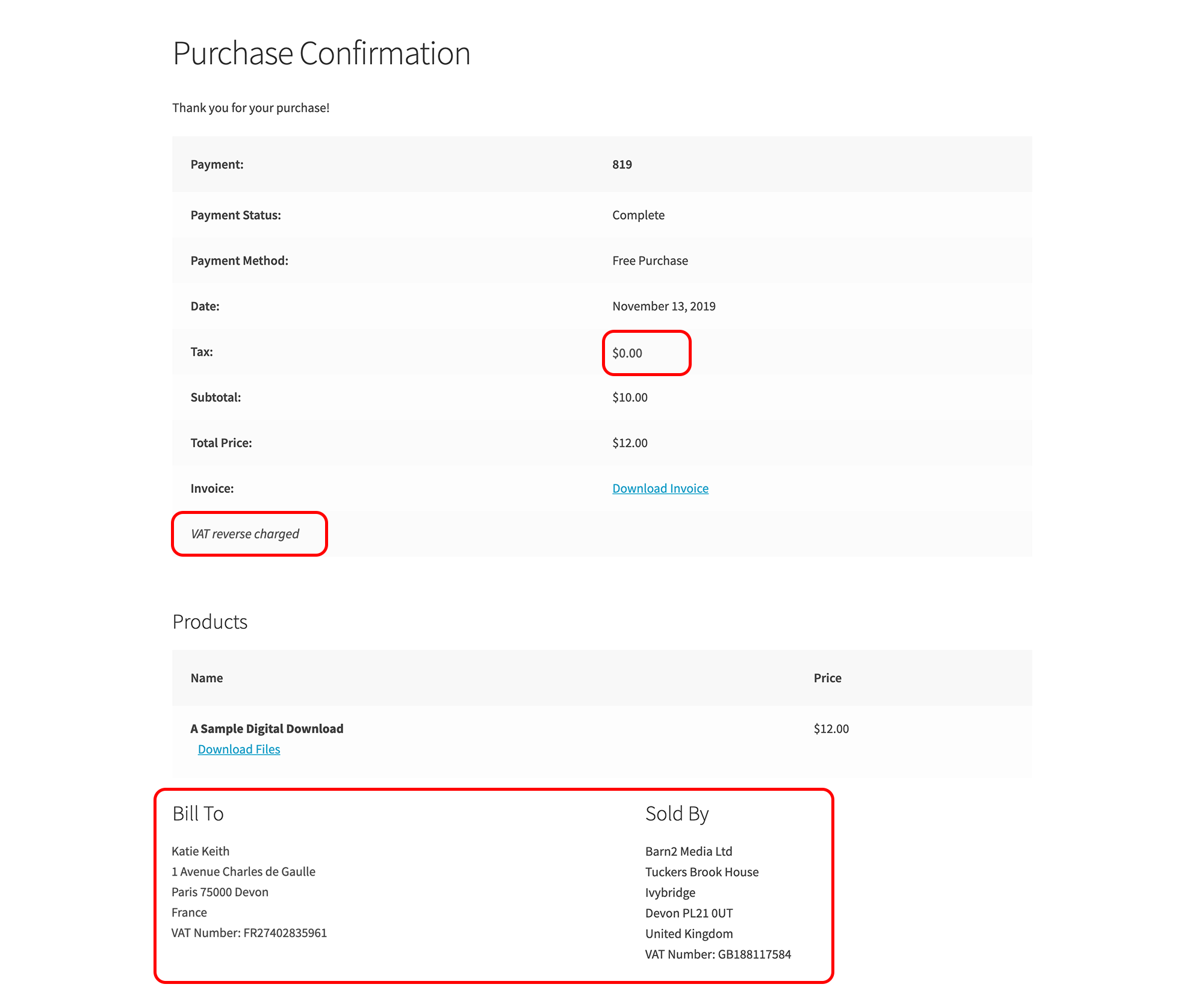

Uk Reverse Charge Vat Invoice Example. Reverse VAT charge - a case example. The reverse charge mechanism aims to reduce bureaucratic expenses and tax-related frauds.

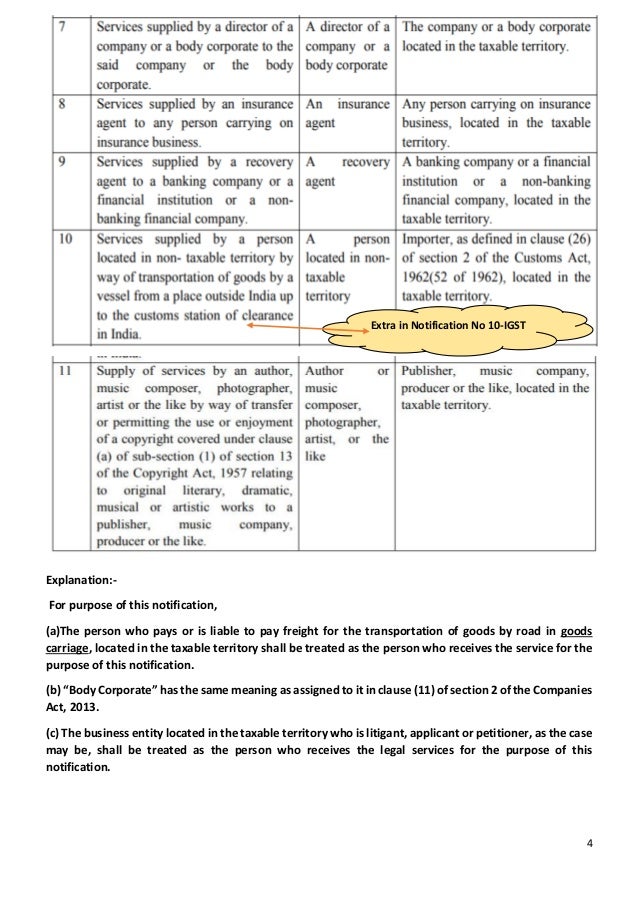

Understand the concept of Reverse Charge mechanism under VAT and find out the goods and services on which VAT needs to be charged under The mechanism of collecting tax by a registered supplier from his customers is known as forward charge mechanism.

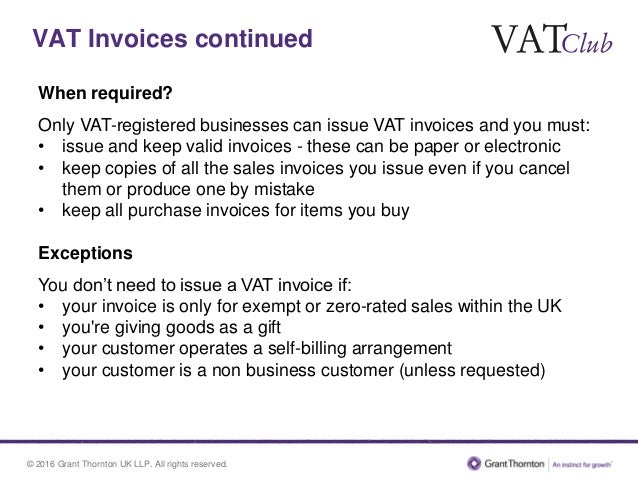

VAT invoices must be compliant with HMRC by VAT invoice requirements.

UK Free Invoice templates (Download as PDF). Reverse Charge is a tax schema that moves the responsibility for the accounting and reporting of VAT from the seller to the buyer of goods and/or services. No, that's saying if a non-UK based supplier who has a UK VAT registration number issues an invoice with UK VAT on it that you still need to apply the reverse charge.